When is the best time to refinance?

There’s no universal answer for the best time to refinance—but here are a few helpful indicators.

Here are some takeaways:

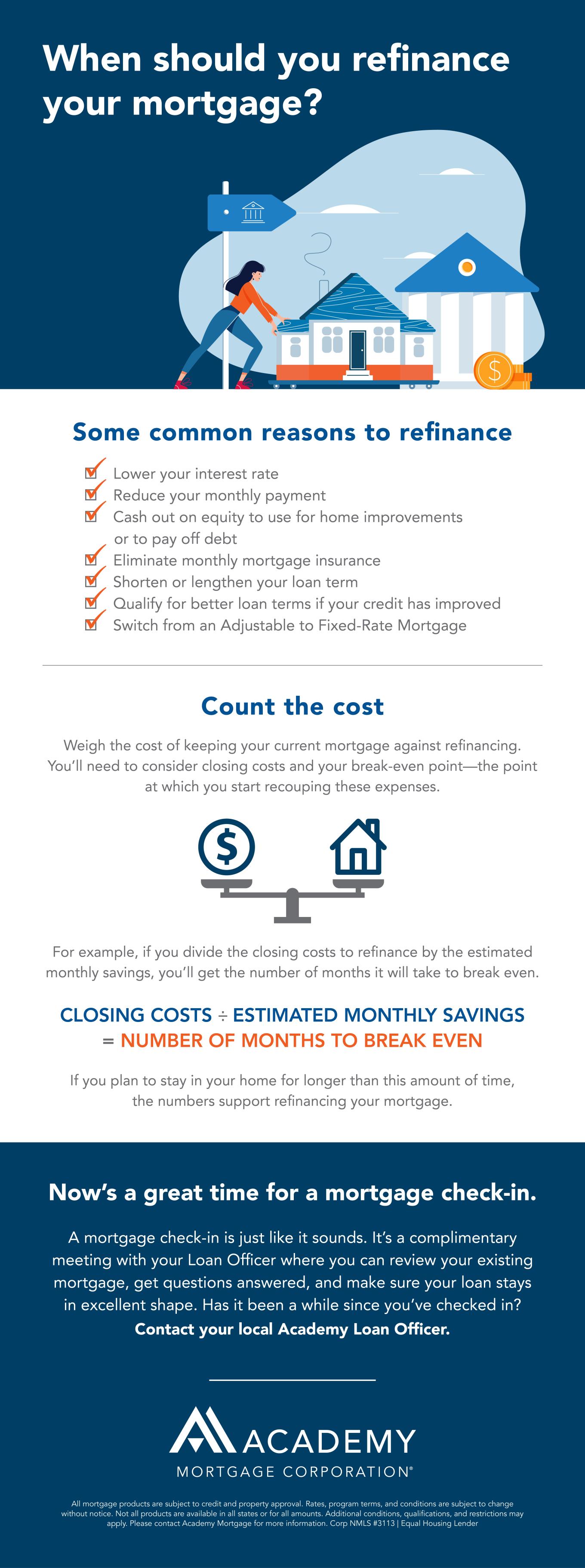

- There are times when it may benefit you to refinance—to lower your interest rate and potentially your monthly payment, to drop the added expense of monthly mortgage insurance, or to cash out on growing home equity, among others.

- When you refinance, you’ll apply for a loan all over again using your credit score, income, and debt-to-income ratio. Similar to how it was when you bought your house, there will be closing costs and other fees attached. Closing costs can vary based on loan amount.

- Checking in with your Loan Officer is the best way to find out if refinancing is right for you. Your Loan Officer can crunch the numbers and help you determine if the long-term savings are worth the upfront cost. You can also use our handy calculator.

✅ If you refinance for an amount greater than what you owe on your home, you can receive the difference in a cash payment to be used as you wish. Contact your local Academy Loan Officer for details.

Signs it’s a good time to refinance your mortgage

There are many reasons to consider refinancing. Let’s take a look at some of the most common:

1. Interest rates have gone down.

If you bought a home at a time when mortgage interest rates were higher than what they are today, this could be an ideal time to refinance. Generally speaking, if current rates are at least 1 percent lower than when you secured your initial home loan, a new loan could save you on your monthly payment. Still, individual factors can vary. Checking in with your Loan Officer can give you the most accurate information.

2. Your credit score has gone up.

Depending on how long ago you bought your house, it’s possible that your credit picture may now look much better than it did back then. If your credit score has improved significantly, you may qualify for a more competitive interest rate. In this scenario, refinancing may potentially cause your monthly mortgage payment to decrease enough to justify the closing costs.

Similarly, it may also be worth revisiting your loan if your income has increased since you first secured your mortgage.

3. You’d like to drop mortgage insurance.

Some low down payment mortgage programs, like FHA Loans, have a monthly insurance premium included. If you have a loan like this, refinancing could be used to take away the mortgage insurance, potentially lowering your monthly payment. Refinancing to increase the length of your loan term may also help lower your monthly payment; your Loan Officer can explain the advantages and disadvantages of doing this.

4. You want to convert to a fixed rate.

Perhaps you bought a house using an Adjustable-Rate Mortgage (ARM) and would like to switch to a Fixed-Rate Mortgage. The uncertainty of how interest rates may fluctuate can be uncomfortable for many borrowers. Refinancing to a Fixed-Rate Loan may help to provide a more predictable monthly payment once an ARM starts to reset, as well as peace of mind.

These are just a few examples of when refinancing makes sense. Other times, refinancing may relate to life changes and be entirely personal to your situation. Whatever your financial picture looks like, it’s helpful to be aware of the option to fine-tune your home loan if it works for you and provides potential savings.

Want to explore what’s possible?

Whether you’ve had major life changes in the past few years or have questions about what to do with the equity you’ve gained, it’s always a good idea to review your mortgage. A mortgage review can also help you identify opportunities to save. To schedule your complimentary check-in, contact your local Academy Loan Officer.

All mortgage products are subject to credit and property approval. Rates, program terms, and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Additional conditions, qualifications, and restrictions may apply. Please contact Academy Mortgage for more information. MAC2412-2180445.